Following the reports of the tariffs unleashed by Donald Trump on the world you'd be forgiven for thinking that we're on the brink of a global economic collapse. The reality, however, is far simpler - and boring.

Any levies on trade are just another form of taxation, that's all.

And guess what – ALL taxation reduces consumer ability to purchase goods.

Income taxes drain your wallet, so your disposable income is lower – you have less money to spend. Sales taxes increase prices of goods, so you can't buy as much as you otherwise could. Excise taxation makes e.g. drinking or smoking more expensive than it need be. Even social security / payroll taxation effectively locks a huge chunk on your income for decades into the future, rendering your monthly paycheck slimmer.

Of course we employ taxes because governments need money to carry out certain roles we expect of them. These are the trade-offs we accept for the greater good. Tariffs are just another such levy.

There were reports of Trump admin looking at sales/VAT taxation to calculate their tariff response and some people didn't understand why. But doesn't e.g. VAT increase the prices of goods, making them more expensive to consumers?

While the logic behind it isn't bulletproof – after sales or value-added taxation affects all goods, regardless of origin, so it doesn't impact the relative competitiveness of American exports – it's perfectly clear that these taxes (reaching in Europe as much as 27% in some countries) negatively impact consumption by making everything more expensive.

Lower demand means fewer sales and fewer sales mean less trade.

For example, the launch price of a basic iPhone 16 last year was $799 in the USA but around $1050 in Germany. That's over 30% more. Has anybody ever protested against this "assault on free trade"?

Since tariffs increase the prices of products sold in a particular market they are essentially a sales tax which is only applied on foreign goods.

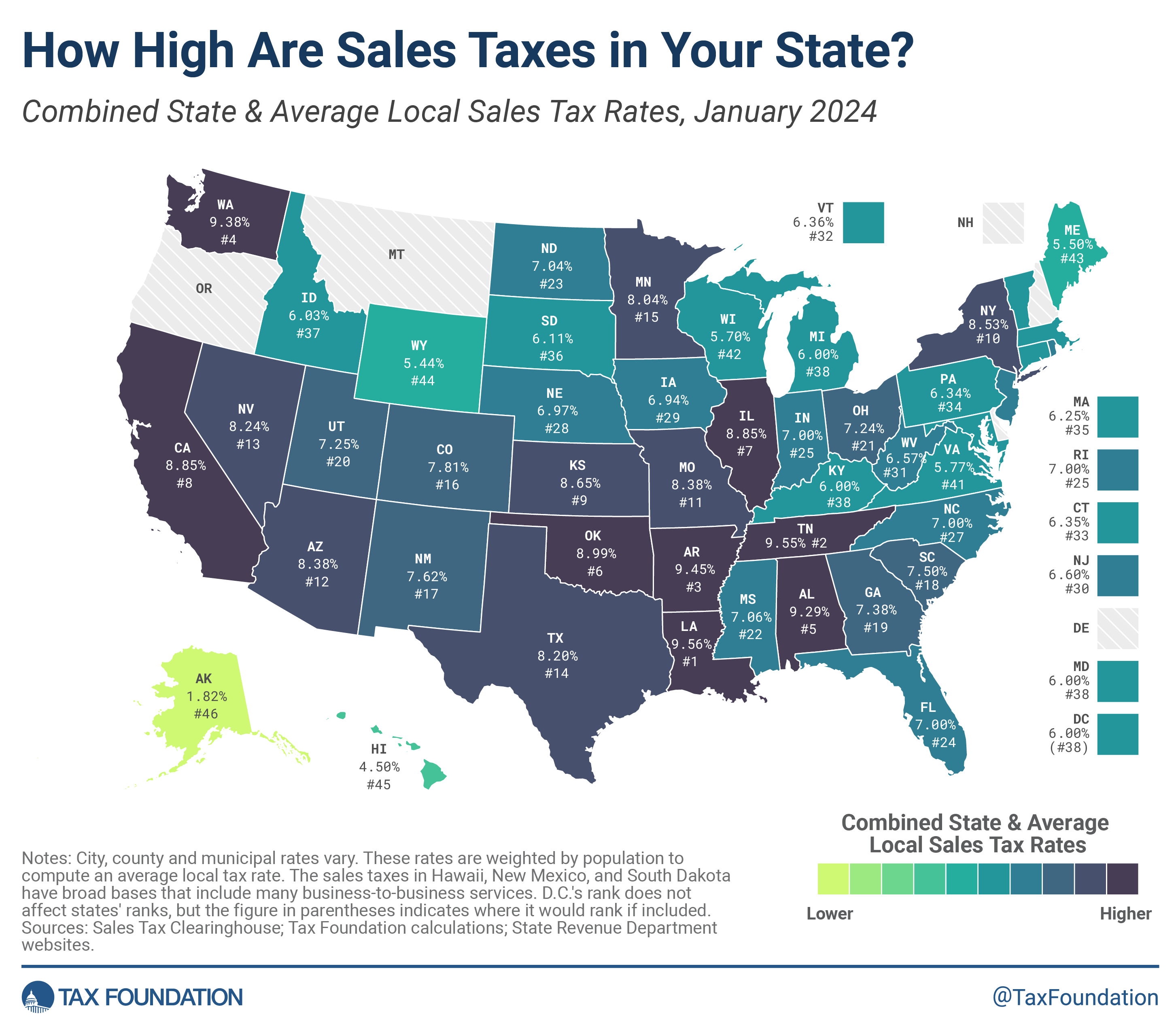

Unlike most other countries, USA doesn't have a nationwide sales tax, just relatively small rates on a local and state level of ca. 5 to 10 percent, depending on the location.

Instead of applying, let's say, a 10 percent levy on all goods (comparable to Japanese GST for instance), Trump administration decided to impose considerably higher rates but only on those coming from abroad, to protect local workers and incentivise domestic manufacturing.

Of course everybody selling into the US is concerned, because it negatively impacts the relative competitiveness of their products, but why should that be a concern for Washington?

When China imposed outright bans on many American technological companies, cutting them off from over a billion of its own consumers, was there a comparable global uproar?

When it forced international businesses to give up their intellectual property for access to the Chinese market we've heard maybe a few grunts of complaint, but everybody fell in line in the end.

Even today it's exceedingly difficult for foreign businesses to sell in China but are there global protests about Beijing crippling the global free trade?

The same could be said about other countries or entire blocks like the European Union, which impose all sorts of regulations to control the flow of goods.

After all, doesn't Singapore levy Additional Registration Fee on cars, which can go up to 320% of the Open Market Value of the vehicle? Doesn't that strangle the imports? Shouldn't car exporting countries be offended?

Of course, it's a domestic policy to reduce car ownership on a land-constrained island - but everybody has their reasons for various obstacles to free trade.

For the US it's the decades of outflow of employment, impoverishing many areas in the country. It's also of strategic importance to be able to manufacture far more domestically than it is now, instead of relying on 3rd parties.

There are other reasons too, but I'll leave that for another article.

My point is simple – tariffs are just a tax and like all taxes they will be judged on how well they accomplished their many goals, some of which are not economic.

And this is why...

Trump assumed most of the risk

While the world is worried, tariffs will merely reshuffle the trade order, and everybody is going to have to adapt to it, and live with it just like we already live with all the obstacles other countries put on imports themselves.

Some will lose more, some less, and others, like Singapore, may even gain in certain areas.

But the person assuming most of the risk for the tariffs is none other than Donald J. Trump himself.

He will be judged on their success or failure. If they don't produce meaningful positives then American people can deprive his party of control of Congress next year and kick Republicans out of the White House once he finishes his term in 2028, making him go down in history in infamy that even his staunchest supporters won't be able to excuse.

I will be publishing more about what he is actually trying to accomplish in future articles, but let me just say that his reasons are not entirely baseless.

His problem, however, is that the benefits of imposing barriers on cheap imports may require far more time to present themselves that he has. Even if successful, reshoring manufacturing will take years, as it takes time to build new factories.

This is why he launched this offensive so early into his presidency, hoping that Americans will understand what the goals were by the time it ends. We'll see how that pans out.

But since we're able to live with the regime in Beijing, we can certainly live with Trump's America.